Buyer Demand Still Outpacing the Supply of Homes for Sale | Matthew Stewart Real Estate Team | Top Producer | Roseville | Granite Bay | Rocklin | Lincoln | Folsom

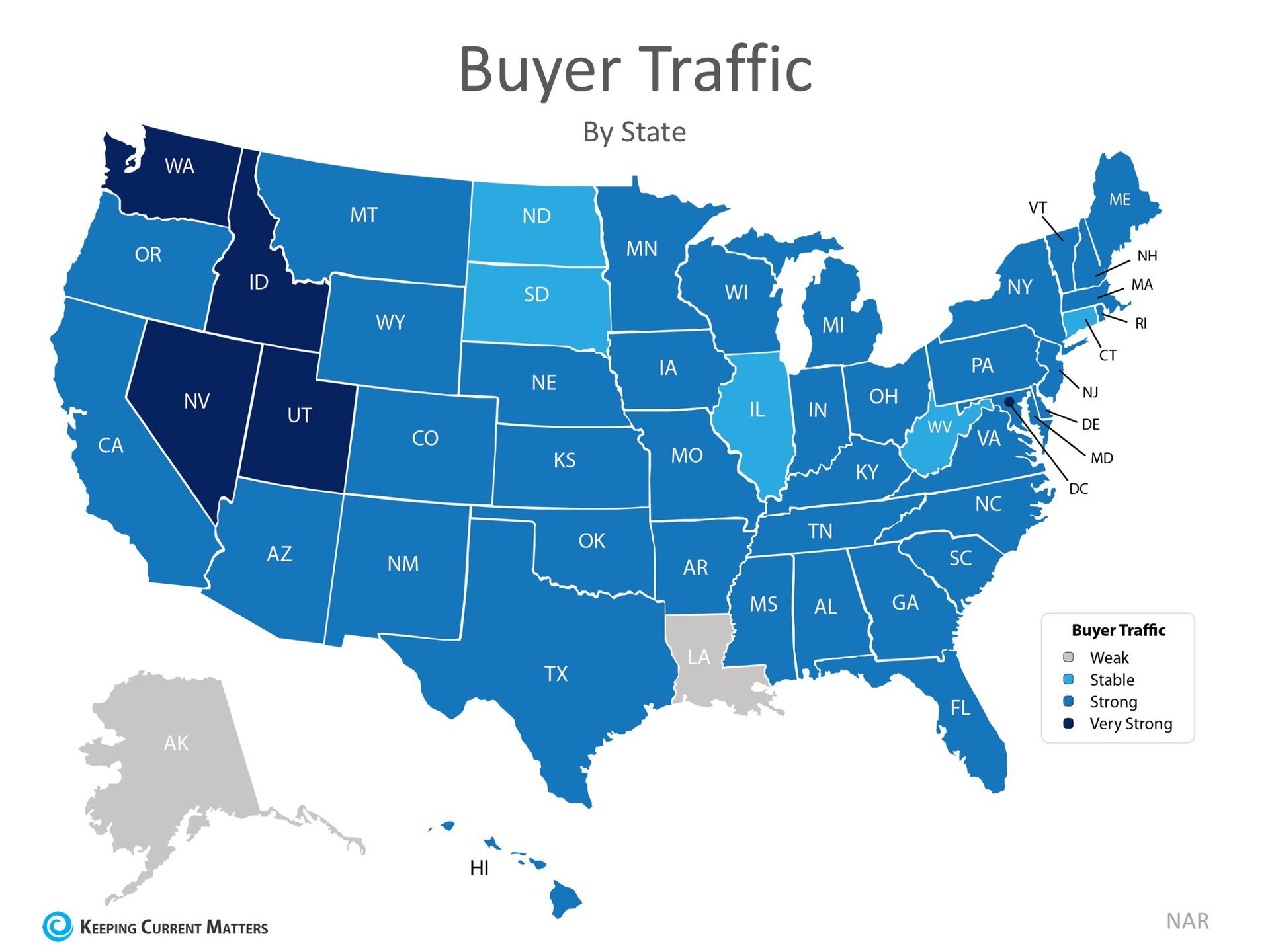

The price of any item is determined by the supply of that item, as well as market demand. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between Seller Traffic (supply) and Buyer Traffic (demand).

Buyer Demand

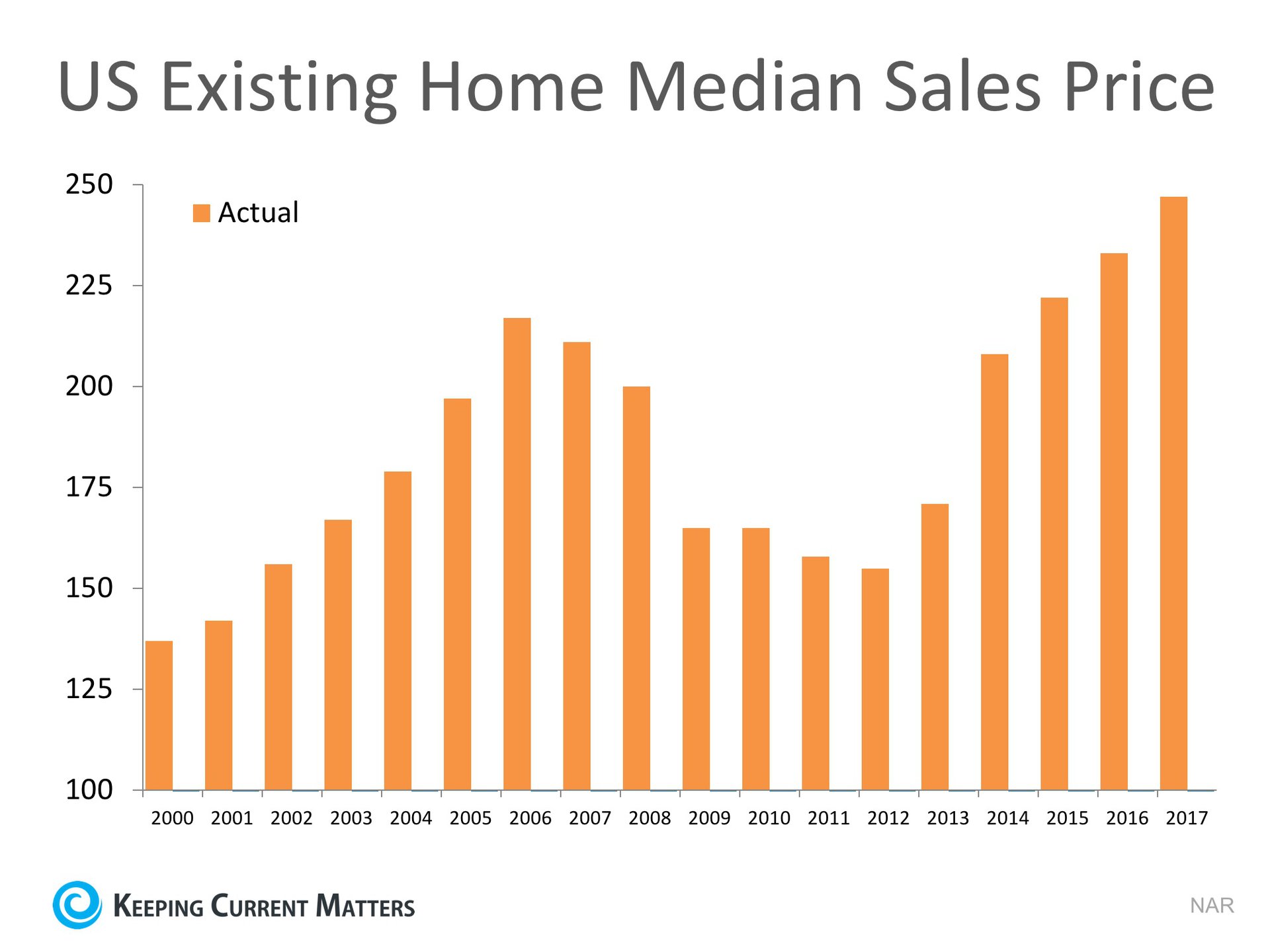

The map below was created after asking the question: “How would you rate buyer traffic in your area?”

Buyer traffic is high in California. Inventory (homes for sale) is down which is putting pressure on the market causing pricing to increase. Sellers should be careful and not over price which will cause them to take longer to sell and generally sell for less money as they adjust price after the largest wave of interest the first 3-4 weeks. Matthew Stewart Real Estate Team | Roseville | Granite Bay | Rocklin | Lincoln | Folsom

The darker the blue, the stronger the demand for homes in that area. Only four states had a ‘stable’ demand level.

Seller Supply

The index also asked: “How would you rate seller traffic in your area?”

As you can see from the map below, 25 states reported ‘weak’ seller traffic, 21 states reported ‘stable’ seller traffic, 3 states and Washington D.C. reported ‘strong’ seller traffic, and only 1 state reported ‘very strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are out looking for their dream homes.

25 states reported weak seller traffic. Buyer demand is stronger than listing inventory which is causing prices to increase. Matthew Stewart Real Estate Team | Granite Bay | Roseville | Rocklin | Lincoln | Folsom | Sacramento

Bottom Line

Looking at the maps above, it is not hard to see why prices are appreciating in many areas of the country. Until the supply of homes for sale starts to meet buyer demand, prices will continue to increase. If you are debating listing your home for sale, meet with a local real estate professional in your area who can help you capitalize on the demand in the market now!

Matthew Stewart Real Estate Team gathered this information from “Keeping Current Matters”

https://www.matthewstewartrealestate.com/about-me

(916) 718-2979

matthewstewartrealestate@gmail.com

20 Quick Tips From People Who Are Winning With Money!!!

My beautiful wife and I recently completed Financial Peace University at our church – Bridgeway Christian in Roseville. It was a wonderful experience that actually brought our entire marriage closer together. Yes, we had argued about money prior to the course, and even more during the 9 week course, but it was revealing things that otherwise would not have been exposed on our own. It forced us to verbalize our views and goals about money. Now we have a unified goal and are moving together in the same direction. I highly recommend the class. It impacted us so positively that we are looking to be co-leaders for the next 9 week class in the Fall. Come join us! I receive Dave’s newsletter and thought I would pass along this article.

Financial Peace University really does work and you can join my wife and me at Bridgeway Church for the start of another 9 week schedule. *No, this is not a picture of us! 😉

Do you ever get frustrated trying to figure out how much to tip?

Next time you’re out to eat and not sure how much to tip your waiter, try this: Double the tax. Depending on where you live, this number will be 12–20% of your total bill. Then you can increase as needed. So easy!

We can all benefit from a few quick money tips, so we asked people who’ve gone through Financial Peace University (FPU)—Dave Ramsey’s most popular nine-week class about money management—to share the most valuable lesson they learned.

Here’s what they had to say:

1. Keep your savings account at a different bank than your checking account.

“That way you don’t see your savings every time you log into your account. You won’t be tempted to transfer it or use it. Out of sight, out of mind!” — Michelle M.

2. Use the budget to help you reach fun goals.

A budget isn’t something you have to do because you’ve been bad. It’s something you do so you can be good. We’re going to Disney and paying cash!” — Alex S.

3. Only buy what you need (and can afford).

“Even though something is a good deal, it doesn’t mean you should buy it.” — Anne M.

4. What matters isn’t how much you’re allowed to borrow but how much you have in the bank.

“Who cares about my FICO score? I don’t.” — Hyunmee P.

5. Don’t let discouragement keep you from making a budget.

“There’s always hope when you have a plan.” — Brandon C.

6. Go old school and balance your checking account.

“This is essential! Balance your checking account so you know where you’re at and then begin with a basic budget. It’s all about taking baby steps.” — Kay N.

7. Give yourself some fun money so you’ll stay on budget.

“I was swiping my card for miscellaneous things. It turns out we were blowing the budget by $150 to $250 a month! I just needed to issue myself an envelope system for pocket money. Now I even have money left over at the end of the month!” — Rick M.

8. Say goodbye to all of your debt.

“I grew up with the misconception that having car loans, a house loan and student loans was something everybody did when they got older. I don’t consider myself debt-free simply because I don’t have any credit card debt. My husband and I are working at paying off all of our debt!” — Amy M.

9. Be patient with purchases—and with yourself.

“We learned to be patient while saving up cash to purchase a new appliance, go on vacation, or buy a car. We also spent over 20 years learning that debt was good, so it took some time to unlearn these things and replace them with new behaviors.” — Katherine E.

10. Get on the same team with your spouse.

“Sitting down together and going over the bills and budget has changed our marriage. There are no more fights about money. We budget together.” — Trina G.

11. Set up a savings fund for irregular expenses.

“My son had just started preschool when I took FPU, so we were in and out of the doctor’s office every week. I now set aside a few dollars in my budget each week for copay and prescription costs. This is a godsend!” — Sandy C.

12. Don’t believe everything society tells you about money.

“Debt can steal your future. It’s so important for kids to understand how to deal with money and debt—and what the consequences of their decisions will look like. You can make better decisions when you know all the facts.” — Susan K.

13. Be prepared for emergencies.

“Having an emergency fund for a rainy day will prevent you from getting a credit card and falling into debt.” — Hyunmee P.

14. Tell your money where to go.

“We learned the importance of a budget and telling our money where to go. It works! We’re now debt-free—that $89,000 owed is gone!” — Angelica A.

15. Put your long-term goals in the right order.

“Retirement should come before saving for my child’s college. I didn’t really think that through before taking the FPU class.” — Shawn H.

16. Use the envelope system.

“Pull money out of your account and put it in envelopes. If it isn’t in your envelope, you can’t use your debit card. We found when we stopped using envelopes for a month we busted our budget. Back to envelopes it is!” — Jennifer B.

17. Talk with your lender to solve any problems while you’re paying off debt.

“Always work with your credit card companies. My bank overcharged me interest, and after we talked, they ended up sending me a check.” — John S.

18. Embrace the power of cash.

“I bought several cars with cash and saved on the purchase price. Also, letting go of cash in hand hurts. I’ve walked away from many purchases in order to keep the cash in my hand.” — Desiree E.

19. Be generous.

“The most important lesson I learned in FPU was to set myself up to be a blessing to others—whether it’s by giving sound financial advice, helping people draft a monthly budget, or giving to someone anonymously.” — Alexander H.

20. Make daily decisions with the end goal in mind.

“The daily choices you make concerning your money dictate what options you will have. Sacrifice in the beginning reaps huge rewards in the end.” — Shelle C.

Matthew Stewart has been a full time real estate agent in the Greater Sacramento Area for over 18 years and has SOLD hundreds of homes. If you have real estate questions or desire his expertise either as a seller or buyer, contact Matthew Stewart Real Estate Team

(916) 718-2979

Latest NAR Data Shows Now Is A Great Time To Sell!

We all realize that the best time to sell anything is when demand for that item is high, and the supply of that item is limited. Two major reports released by the National Association of Realtors (NAR) revealed information that suggests that now is a great time to sell your house.

Let’s look at the data covered in the latest REALTORS® Confidence Index and Existing Home Sales Report.

REALTORS® CONFIDENCE INDEX

Every month, NAR surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions.” This month, the index showed (again) that homebuying demand continued to outpace the supply of homes available in January.

The map below illustrates buyer demand broken down by state (the darker your state, the stronger demand there is).

In addition to revealing high demand, the index also shows that compared to conditions in the same month last year, seller traffic conditions were ‘weak’ in 22 states, ‘stable’ in 25 states, and ‘strong’ in only 4 states (Alaska, Nevada, North Dakota & Utah).

Takeaway: Demand for housing continues to be strong but supply is struggling to keep up, and this trend is likely to continue throughout 2018.

THE EXISTING HOME SALES REPORT

The most important data revealed in the report was not sales but was instead the inventory of homes for sale (supply). The report explained:

- Total housing inventory rose 4.1% from December to 1.52 million homes available for sale.

- Unsold inventory is 9.5% lower than a year ago, marking the 32nd consecutive month with year-over-year declines.

- This represents a 3.4-month supply at the current sales pace.

According to Lawrence Yun, Chief Economist at NAR:

“Another month of solid price gains underlines this ongoing trend of strong demand and weak supply. The underproduction of single-family homes over the last decade has played a predominant role in the current inventory crisis that is weighing on affordability.”

In real estate, there is a guideline that often applies; when there is less than a 6-month supply of inventory available, we are in a seller’s market and we will see appreciation. Between 6-7 months is a neutral market, where prices will increase at the rate of inflation. More than a 7-month supply means we are in a buyer’s market and should expect depreciation in home values.

As we mentioned before, there is currently a 3.4-month supply, and houses are going under contract fast. The Existing Home Sales Report shows that 43% of properties were on the market for less than a month when sold.

In January, properties sold nationally were typically on the market for 42 days. As Yun notes, this will continue unless more listings come to the market.

“While the good news is that Realtors in most areas are saying buyer traffic is even stronger than the beginning of last year, sales failed to follow course and far lagged last January’s pace. It’s very clear that too many markets right now are becoming less affordable and desperately need more new listings to calm the speedy price growth.”

Takeaway: Inventory of homes for sale is still well below the 6-month supply needed for a normal market and supply will ‘fail to catch up with demand’ if a ‘sizable’ supply does not enter the market.

Bottom Line

If you are going to sell, now may be the time to take advantage of the ready, willing, and able buyers that are still out searching for your house.

This post taken with permission from Keeping Current Matters

Impact of the 2018 Tax Law on Real Estate Owners

The new tax law reform is a reality. Do you know what changed? What stayed the same? How it affects you?

Congress has approved sweeping tax cuts and tax reform that have not been tackled by the federal government in over 30 years (since the Tax Reform Act of 1986.). The tax law, formally referred to as “The Tax Cuts and Jobs Act,” will go into effect January 1, 2018. This article has the most up-to-date information along with a summary of how the tax law provisions will affect homeowners and real estate investors who own all types of investment property. Although this article generally does not delve into tax issues not associated with real estate, there are many new tax provisions and this is essential information for anyone that owns real estate to understand.

Primary Residence Homeowners

As a result of doubling the standard deduction to $12,000 for single filers and $24,000 for married filing jointly, according to Moody’s Analytics, as many as 38 million Americans who would otherwise itemize may instead choose the higher standard deduction under the new tax plan. The doubling of the standard interest deduction, in essence, removes a previous tax incentive of moving from renting a residence to home ownership. A likely unintended outcome will be fewer Americans choosing to become homeowners versus renting a residence solely for the tax advantages.

Any home mortgage interest debt incurred before December 15, 2017, will continue to be eligible for the home mortgage interest deduction up to $1,000,000. Any home mortgage interest debt incurred after this date will be limited to no more than $750,000 qualifying for the home mortgage interest deduction. Beginning 2018, the deduction for interest paid on a home equity line of credit (“HELOC”) will no longer be eligible for the home mortgage interest deduction. However, the tax law preserves the deduction of mortgage debt used to acquire a second home. This should have a positive impact on supporting property values in resort and vacation destinations.

State and local taxes (referred to collectively as “SALT”) can be deducted, but will no longer be unlimited as under previous tax law. The 2018 tax law will allow homeowners to deduct property taxes and either income or sales taxes with a combined limit on these deductions being limited to no more than $10,000. Top earners who live in a state with higher taxes like California, Connecticut, Oregon, Massachusetts, New Jersey, New York will be negatively affected the most by no longer having the previous full federal deduction available. There is the potential for home values in high state tax areas on both the West Coast and East Coast to see a reduction in property values partially due to the new capped SALT deduction at $10,000 and partially due to the new maximum $750,000 home mortgage deduction. A National Association of REALTORS™ study found there could be a drop in home prices up to 10 percent in these and other high state tax areas as a result of limitations in the tax law that won’t be as favorable as prior law for some property owners.

Both the House and Senate tax bills had originally proposed increasing the length of time a homeowner would need to live in a primary residence (from five out of eight years versus the current requirement to live in a primary residence two out of five years to qualify for the Section 121 tax exclusion). This proposed change did not become a part of the 2018 tax law. Homeowners will continue to only need to live in their primary residence 24 months in a 60 month time period to be eligible for tax exclusion up to $250,000 if filing single and up to $500,000 if married filing jointly. Property owners will still have the ability to convert a residence into a rental property or convert a rental property into a residence and qualify for tax exclusion benefits under both the primary residence Section 121 rules and also potentially qualify for tax deferral on the rental property under the Section 1031 exchange rules.

Investment Property Owners

Investment property owners will continue to be able to defer capital gains taxes using 1031 tax-deferred exchanges which have been in the tax code since 1921. No new restrictions on 1031 exchanges of real property were made in the tax law. However, the tax law repeals 1031 exchanges for all other types of property that are not real property. This means 1031 exchanges of personal property, collectibles, aircraft, franchise rights, rental cars, trucks, heavy equipment and machinery, etc will no longer be permitted beginning in 2018. There were no changes made to the capital gain tax rates. An investment property owner selling an investment property can potentially owe up to four different taxes: (1) Deprecation recapture at a rate of 25% (2) federal capital gain taxed at either 20% or 15% depending on taxable income (3) 3.8% net investment income tax (“NIIT”) when applicable and (4) the applicable state tax rate (as high as an additional 13.3% in California.)

Some investors and private equity firms will not have to reclassify “carried interest” compensation from the lower-taxed capital gains tax rate to the higher ordinary income tax rates. However, to qualify for the lower capital gains tax rate on “carried interest,” investors will now have to hold these assets for three years instead of the former one-year holding period.

Some property owners, such as farmers and ranchers and other business owners, will receive a new tax advantage with the ability to immediately write off the cost of new investments in personal property, more commonly referred to as full or immediate expensing. This new provision is part of the tax law for five years and then begins to taper off. There are significant concerns these business and property owners will face a “tax cliff” and higher taxes once the immediate expensing provision expires.

Investment property owners can continue to deduct net interest expense, but investment property owners must elect out of the new interest disallowance tax rules. The new interest limit is effective 2018 and applies to existing debt. The interest limit, and the real estate election, applies at the entity level.

The tax law continues the current depreciation rules for real estate. However, property owners opting to use the real estate exception to the interest limit must depreciate real property under slightly longer recovery periods of 40 years for nonresidential property, 30 years for residential rental property, and 20 years for qualified interior improvements. Longer depreciation schedules can have a negative impact on the return on investment (“ROI”). Property owners will need to take into account the longer depreciation schedules if they elect to use the real estate exception to the interest limit.

The tax law creates a new tax deduction of 20% for pass-through businesses. For taxpayers with incomes above certain thresholds, the 20% deduction is limited to the greater of: 50% of the W-2 wages paid by the business or 25% of the W-2 wages paid by the business, plus 2.5% of the unadjusted basis, immediately after acquisition, of depreciable property (which includes structures, but not land). Estates and trusts are eligible for the pass-through benefit. The 20% pass-through deduction begins to phase-out beginning at $315,000 for married couples filing jointly.

Taxpayers are now restricted from deducting losses incurred in an active trade or business from wage income or portfolio income. This will apply to existing investments and becomes effective 2018.

State and local taxes paid in respect to carrying on a trade or business, or in an activity related to the production of income, continue to remain deductible. Accordingly, a rental property owner can deduct property taxes associated with a business asset, such as any type of rental property.

This article was provided by ASSET PRESERVATION – a 1031 exchange company, and is only intended to provide a brief overview of some of the tax law changes, which will affect any taxpayer who owns real estate and is not intended to provide an in-depth overview of all the tax law provisions. Every taxpayer should review their specific situation with their own tax advisor. There is no guarantee of accuracy.

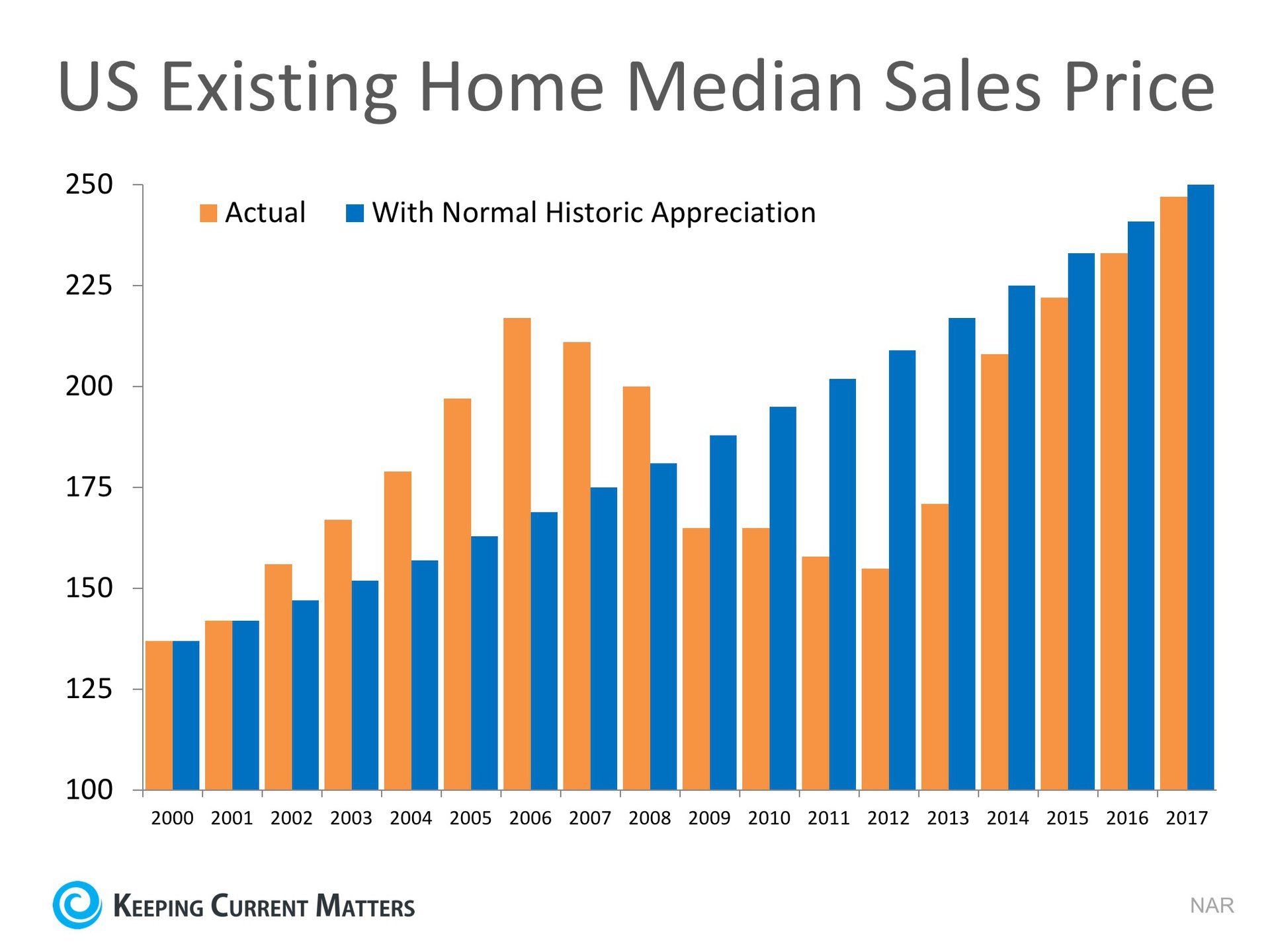

If You’re Considering Selling – ACT NOW!!

Definitely an aggressive headline. However, as the final data on the 2017 housing market rolls in, we can definitely say one thing: If you are considering selling –

IT IS TIME TO LIST YOUR HOME!

It is time to list your home for sale. Inventory is down, buyer demand is way up! | Matthew Stewart Real Estate | Granite Bay | Roseville | Rocklin | Folsom | El Dorado Hills | Lincoln

How did we finish 2017?

- New-home sales were at their highest level in a decade.

- Sales of previously owned homes were at their highest level in more than a decade.

- Starts of single-family homes were their strongest in a decade and applications to build such properties advanced to the fastest pace since August 2007.

And Bloomberg Business just reported:

“America’s housing market is gearing up for a robust year ahead. Builders are more optimistic, demand is strong and lean inventory is keeping prices elevated.”

And the National Association of Realtors revealed that buyer traffic is stronger this winter than it was during the spring buying season last year.

The only challenge to the market is a severe lack of inventory. A balanced market would have a full six-month supply of homes for sale. Currently, there is less than a four-month supply of inventory. This represents a decrease in supply of 9.7% from the same time last year.

A normal real estate market is 6 months of inventory. We currently are under 4 months of inventory = Sellers market!

Bottom Line

With demand increasing and supply dropping, this may be the perfect time to get the best price for your home. Contact the Matthew Stewart Real Estate Team today to see whether that is the case in your neighborhood. A market analysis and current inventory levels report will be generated through Matthew’s knowledge, tools, and experience.

http://www.matthewstewartrealestate.com

(916) 718-2979

The Impact Of Tight Inventory On The Housing Market

Housing inventory is tight….making for a great time to sell you home to realize top demand and therefore top value!

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, and distressed sales (foreclosures and short sales) have fallen to their lowest points in years. It seems that the market will continue to strengthen in 2018.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping up.

Here are the thoughts of a few industry experts on the subject:

National Association of Realtors

“Total housing inventory at the end of November dropped 7.2 percent to 1.67 million existing homes available for sale, and is now 9.7 percent lower than a year ago (1.85 million) and has fallen year-over-year for 30 consecutive months. Unsold inventory is at a 3.4-month supply at the current sales pace, which is down from 4.0 months a year ago.”

Joseph Kirchner, Senior Economist for Realtor.com

“The increases in single-family permits and starts show that builders are planning and starting new construction projects, that’s a good thing because it will help to relievethe shortage of homes on the market.”

Sam Khater, Deputy Chief Economist at CoreLogic

“Inventory is tighter than it appears. It’s much lower for entry-level buyers.”

Bottom Line

If you are thinking of selling, now may be the time. Demand for your house will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price.

YOUR BBQ CALLED…HE WANTS TO MEET YOU HERE!

Ever dream of getting out of the traffic filled, fast paced lifestyle of the city and suburbs?

Now is your chance!

COMING TO THE MARKET SOON – this nearly 3,000 square foot home boasts 3/4 bedrooms, 3 baths, a detached 2 car garage with extra space, and sits on a fenced 5 acre parcel near a creek at the end of a private lane! All this for under $500K. Can you believe it? It won’t be available for long…get in touch with Matthew Stewart Real Estate Team at Realty World American River Properties for a private showing. (916) 718-2979 or visit our website at www.matthewstewartrealestate.com

LESSON LEARNED…

LESSON LEARNED…

I took my new bride (is it still a new bride or groom after eight months? Maybe a better question would be…when are we not “new” bride and groom?) to Top Golf for our weekly date night. We had gone out once before and she had done extremely well for someone who had never swung a club before. In fact, it was amazing how she had maintained the grip, posture and swing through out. She consistently hit ball after ball with great contact down the middle. She was hooked and had a desire for more. In fact on Valentines she got me a Top Golf gift card…so I would take her to Top Golf again! LOL

A little background…I played collegiate golf for Sierra College for two years and then nearly seven years later I was recruited by William Jessup University to create a men’s golf program and be its first Men’s golf coach. I was hired in 2007 and coached until 2012 when I stepped down to pursue building an international business…but that’s a story for another e-newsletter.

As we were out this 2nd time it became a little more apparent to Lexi that golf is a game that is learned over time and no one person on the planet has simply picked up a “stick” and excelled at the game without much practice and dedication. She did not hit ball after ball down the middle this time (which is very normal – let’s face it, golf is the hardest game invented to master). She got frustrated. It seemed a lot more difficult and confounding this go-round. I had made some suggestions to her as she was hitting. She “tried” them, but once the “try” ended with a poor result it was quickly dropped with an, “it doesn’t feel right or I can’t do that, etc.” In that moment as I expressed my frustration (not very kind and understanding on my part), I understood more clearly when people would say that husbands shouldn’t give lessons to their wives. I get too focused on the lesson rather than just having fun; clueless to the fact that if she’s having fun, she’ll want to do it again with me. It would be better for both if a 3rd party professional was hired. One nugget of wisdom that came out of this experience (sadly, after the “discussion” of she wasn’t coachable wanting to do it her way, and I wasn’t very kind, nor very fun, etc. had calmed down) was the fact that we can be too much results driven rather than process driven. Lexi was judging her shot as good or bad based on the result of the golf ball rather than the process of learning a golf swing. I shared with her that the professionals who make millions of dollars do not hit every shot perfect or pure. Sadly, because of television which cuts from one player to the next, only showing the amazing shots, we are left thinking that the pro’s don’t miss, yet those of us that have played the game at a high level can certainly attest, “the game is a game of misses.”

Something hit me as I was trying to communicate to Lexi about the frustration she was experiencing. I realized that she was basing her success or failure of performance by what the little white golf ball did and not on what the process of her swing development was. I was looking at her swing, the mechanics – her grip, her stance, weight shift, etc. I told her that what the golf ball did at this stage did not matter, that she would have many more bad shots than good, and that was perfectly normal. What she needed to focus on were three things:

1) Believe what your coach is telling you. (true compliments/encouragement, “great swing, really good grip, great tempo on that one, etc.)

2) Do what the coach tells you to do even when it doesn’t feel good or right (how could a brand new golfer know what was right or wrong?).

3) Give yourself a break. Golf is hard and it takes time to be good. Be patient and enjoy the process.

Later that week Lexi and I were having a “discussion” and she let me know to stop looking at the result in the moment but rather to focus on “the process.” Before the sentence had finished I realized she was right and I was stopped in my tracks! No, not because she was right (she is right A LOT), but rather she had actually listened to her coach! 🙂

**Lexi and I met while attending Bridgeway Church in Roseville. Her beautiful red hair flowing down in a soft wavy cascade called to me from the row in front. We dated for a little over three years (yes I was scared, I had been married before and didn’t want to make a bad or wrong decision this time) and became engaged when I surprised her with a road trip to Lovers Point near Monterey on February 28th 2016. We were married June 22nd 2016. Having no kids prior, I now have three teenagers that I learn from daily!